MUDRAKSH & McSHAW

Conquering Markets With Quants

ANALYZE, STRATEGIZE, CODE, BACKTEST, CODE AND DEPLOY

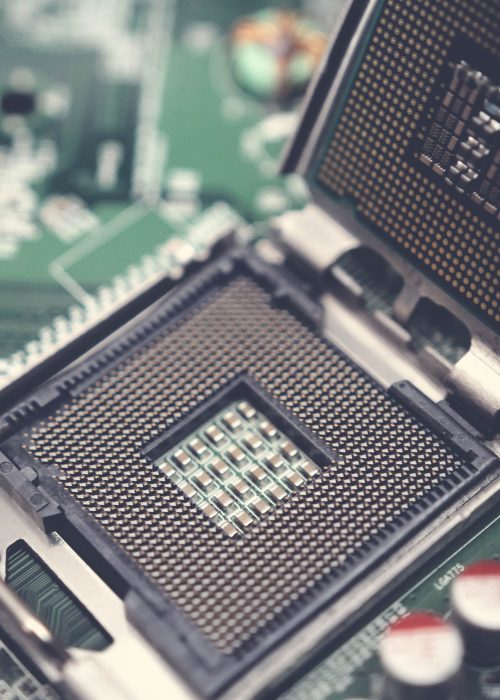

Central to our operations lies a state-of-the-art algo-trading platform meticulously developed in-house by our dedicated technology team. This platform, distinguished by its seamless integration of artificial intelligence and machine learning, underscores our unwavering commitment to innovation, ensuring unparalleled stability and robustness.

Combined with our years of experience, deep knowledge of global markets, we aim to revolutionize the conventional ways of trading.

What We Believe

- Market efficiencies and dynamics are in a continuous transition, therefore quantitative strategies must adapt to this.

- Market volatility, cross-asset interdependence and risk premium will change with time.

- Any existing model’s efficiency and effectiveness will change over time.

- Advanced risk analytics, strategic models and factor analysis will contribute in identifying innovative and adaptive opportunities.

- Managing risk is an important source of creating market alpha.

- Utilizing AI-driven automation and meticulously trained ML models can streamline tasks with exceptional precision

What We Offer

Alpha Centric

Our top priority remains the same — managing our clients’ assets for consistent, high-quality returns.

Innovation as approach

Advance Technology dwells at the heart of our approach. From data collection to strategy deployment we use complex algorithms to maintain quality and performance.

Rigorous Research

Our dedicated research team provides us with the data to invest our client’s money in high yielding assets so that an ideal risk-return profile is maintained.

Core Competencies

Controlled VaR

At the heart of our approach lies Risk Optimization, our guiding principle. Utilizing advanced AI technology, our portfolio management services are finely tuned to align with investors’ risk preferences. By eradicating human biases, we ensure disciplined risk management, safeguarding your capital diligently while maximizing returns.

All Weather Strategies

Harnessing automated monitoring across diverse markets, our AI platform excels in implementing sophisticated trading strategies. Prioritizing high-quality executions, our algorithms adeptly navigate fluctuating market conditions, guaranteeing a steady and dependable return on investments.

Automated Execution

Drawing upon our cutting-edge algorithmic trading infrastructure, we automate the complex trading process, guaranteeing prompt and effective order execution. Fueled by Artificial Intelligence, our system operates devoid of human biases, facilitating a disciplined approach crucial for consistently achieving market returns.